In this article, we will introduce you how to navigate perpetual contracts on OrangeX.

①Contracts ②Trading Chart ③Order Book ④Order Zone ⑤Position Tab ⑥Recent Trade ⑦Margin &Perpetual Assets & Perpetual Details

Understanding order zone makes it easier for you to start the trading.

Click1, traders can switch your margin mode between Cross and Isolate.The default margin mode is cross margin with 25x leverage.

Click2, traders can change the leverage multiplier.

Trader can change the margin mode and leverage even when there is position opened, as long as trader has sufficient available balance to cover the increased margin required (when changing to lower leverage).

Click3, traders can also use calculator to calculate the estimated PNL, Target Price, Liq. Price and Entry price.

OrangeX's USDT perpetual contract supports both Hedging mode and One-Way mode. Traders can choose their position mode from the settings: One-Way or Hedge mode. (Default will be Hedge Mode)

When Hedge mode is selected, traders will see the open and close tab. If a trader wants to open a two way position, the trader can use the "Open" tab to place long and short orders. If the order is for closing purposes, traders can use the "Close" tab to close long or short positions.

When One-Way mode is selected, traders just need to select Buy/Long or Sell/Short.

OrangeX provides 4 order types: Limit Order, Market Order, Conditional Order and Trailing Order.

Limit Order: Limit orders can be executed immediately when the order price is set at a worse price point relative to the best bid/ask price. On the other hand, if the order price is at a better price point relative to the best bid/ask price, the limit order will enter the order book, pending execution.

Market Order: The order will be immediately filled at the best available price from the order book. Traders are not able to set the order price.

Conditional Order: Conditional order is a set of order types that allow traders to set a trigger price on top of a market order (known as conditional market) or limit order (known as conditional limit) before submitting the order.

Trailing Order: A trailing order adjusts the price at a fixed number of points below or above the market price. Trailing orders may have increased risks due to their reliance on trigger pricing.

For more information, please refer to

How to use Market Order/Limit Order/Conditional Order?

How to use trailing order?

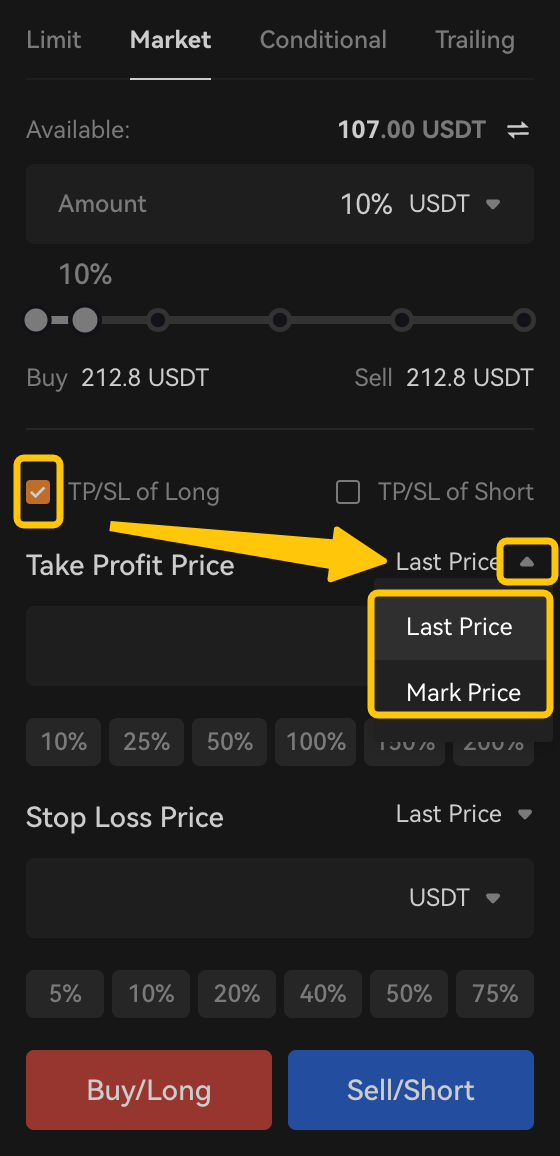

Trader can pre-set their take profit (TP) and stop loss (SL) order when placing an order. Trader can also select their preferred reference price (Last Price or Mark Price) to trigger their TP/SL according to their own trading strategies.

For more information, please refer to

How to check position and history tabs ?

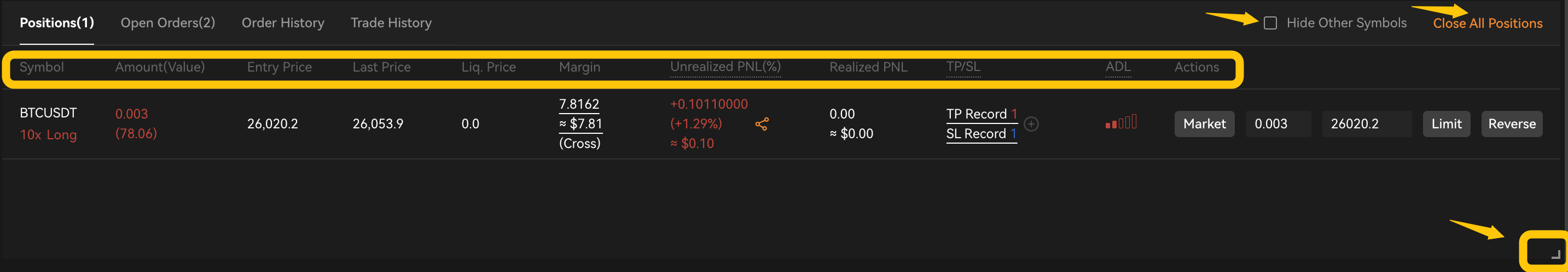

You will find position tab and other history tabs at the bottom of trading page. Click "」" icon, you can zoom out or zoom in the tab.

There are 2 quick action buttons. Check [Hide Other Symbols], the tab will display current trading pair's information only. Click [Close All Positions], all available positions will be closed at the best price excluding closing position orders.

Instruction on Position Tab

Symbol: This shows the trading pair of the position the trader is currently holding. You can also check your position direction and leverage here.

Amount/Value: This refers to position size. In USDT perpetual contract: Amount refers to token quantity, Value = token quantity * entry price

Entry Price: This refers to the average entry price of the position.

Last Price: This refers to the latest traded price of the current trading pair.

Liq. Price: This shows the liquidation price of trader's position. Please note that OrangeX use mark price to trigger liquidation. When mark price reached the liquidation price, liquidation will be triggered and trader will lose all the position margin input.

Margin: This shows the cost of contracts trader has placed.

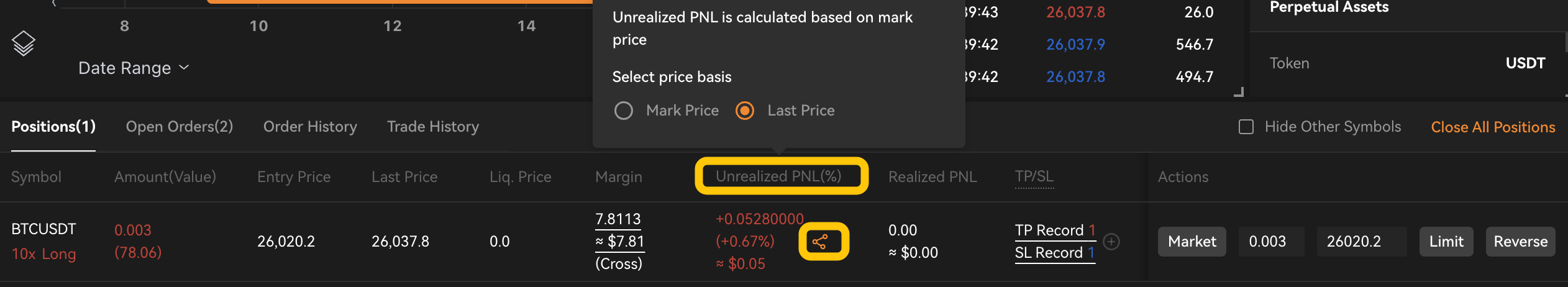

Unrealized PNL(%): This shows the loss and gains of the position. Click the item name, you can select to calculate the unrealized PNL on mark price or last price.(Default will be mark price).

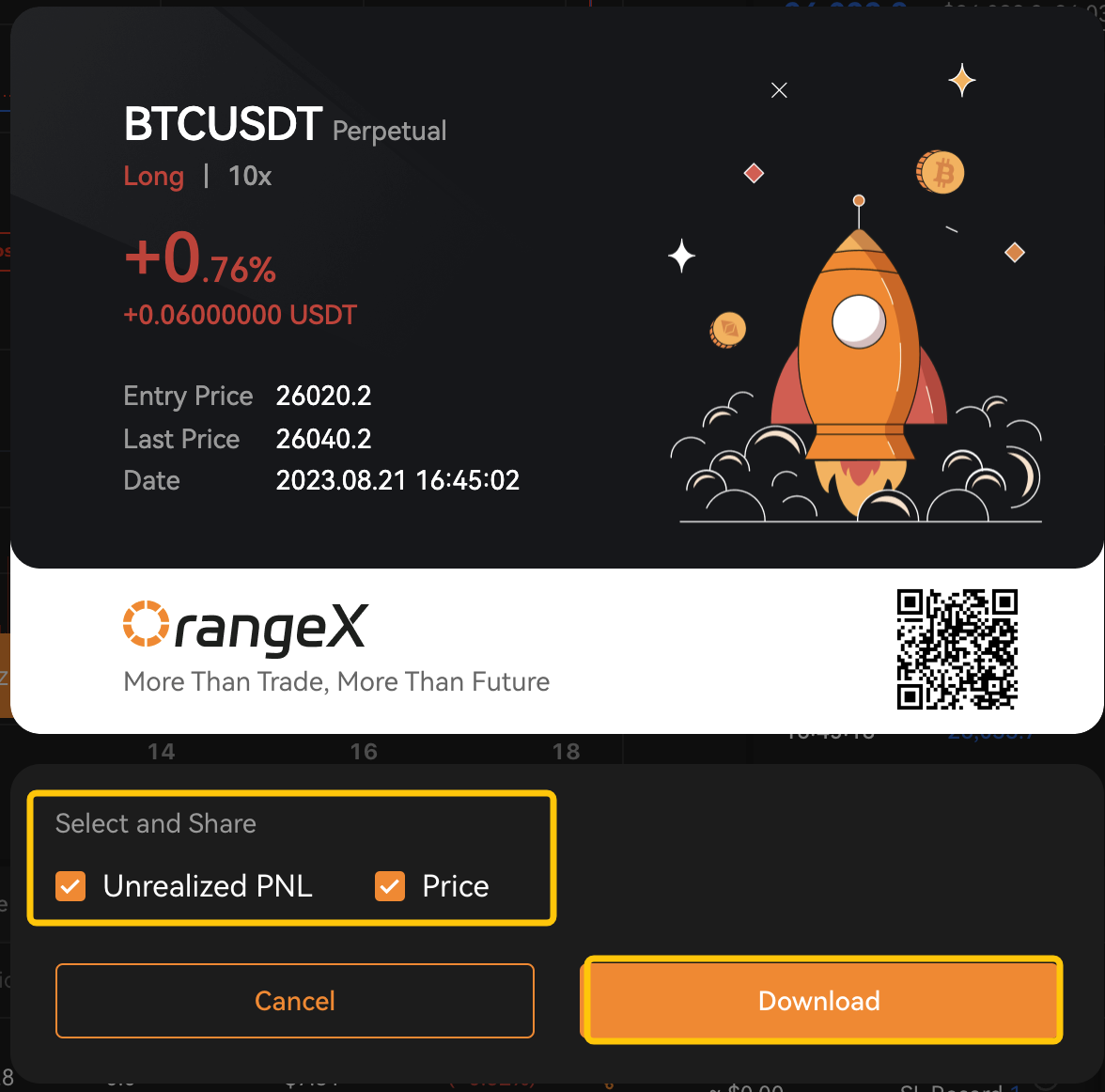

Click the share icon, you can get your position yield poster and share this picture with your friends!

Realized PNL: This shows the sum of realized PNL of the position over the period. This includes all the trading fees, funding fees, and any position PNL realized from partial closing (same formula as unrealized P&L). The realized PNL updates in real time and accumulates until the respective direction of position is fully closed.

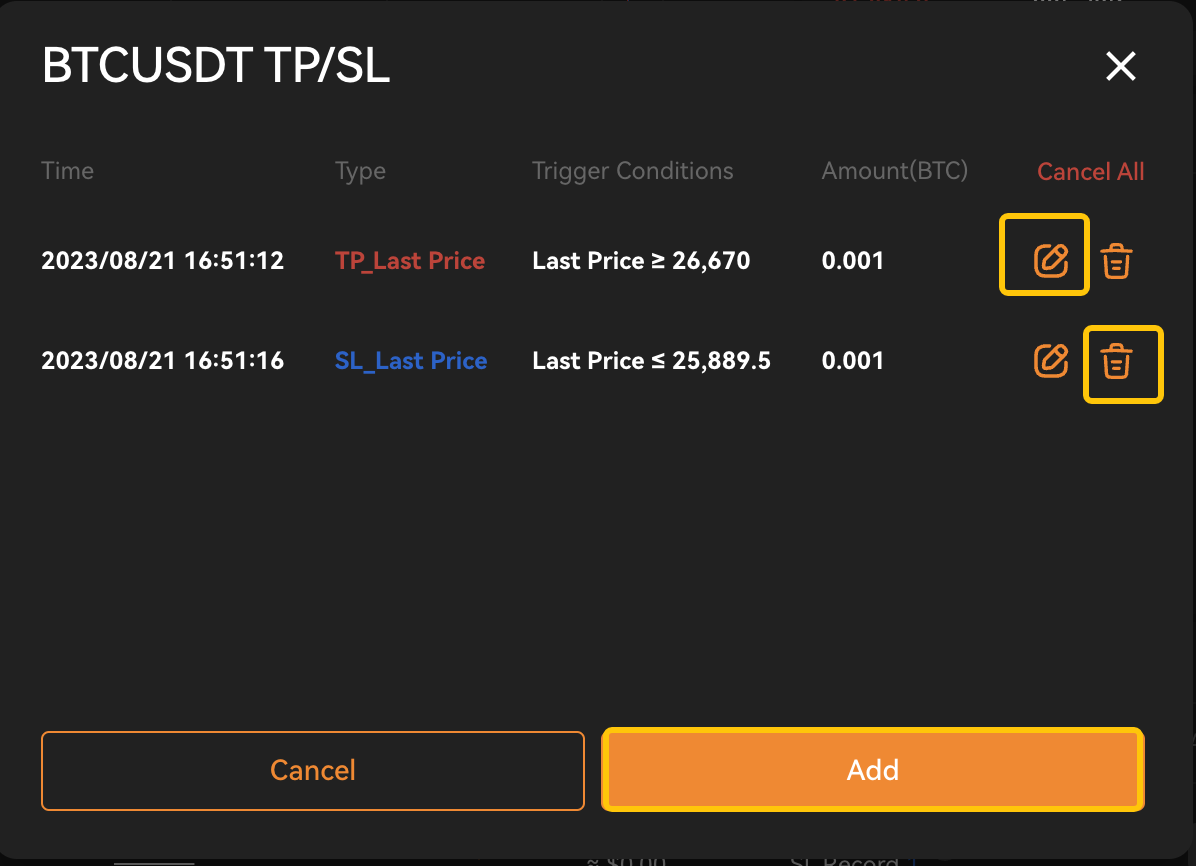

TP/SL: Trader can set their take profit (TP) and stop loss (SL) order from the position tab. OrangeX supports two TP/SL mode on position, which are TP/SL on entire position or TP/SL on selected position (partial position). Click the plus icon or existing record, you can newly add, delete or edit the existing TP/SL records.

ADL: This shows the ADL ranking of the position. In the event of ADL (auto-deleveraging) happened, trader with the highest ranking in the system is prioritized and selected to deleverage first. The auto deleveraging ranking is derived in order of highest profit and effective leverage use.

Actions: Trader can do some quick adjustments from the position tab. Click [Market], you can close the position at market price. Click [Limit],you can close the position at limit price. Click [Reverse], you can quickly close current position and create a new position at opposite direction.

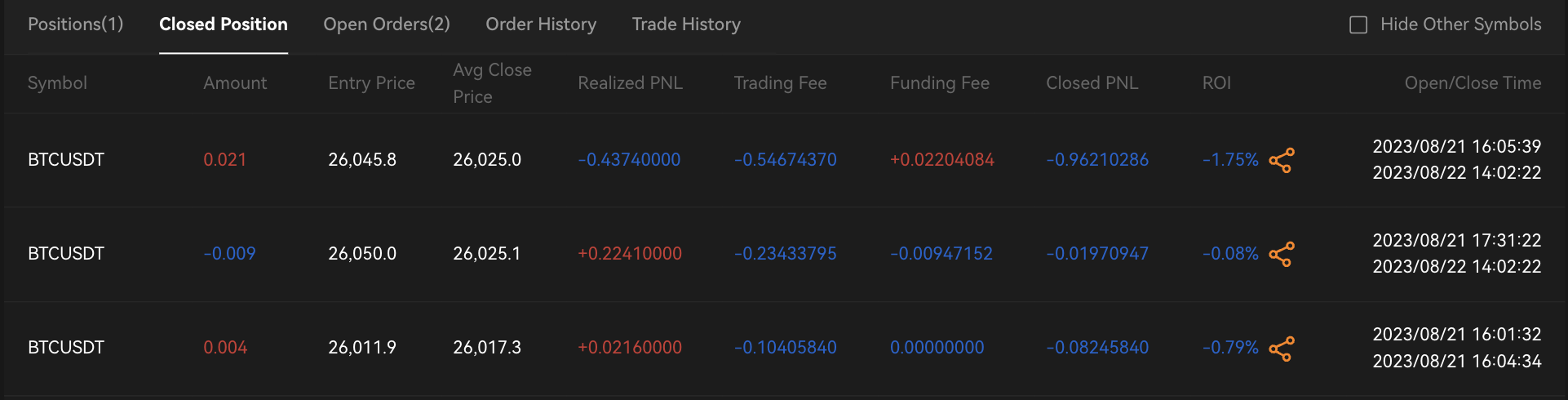

Instruction on Closed Position

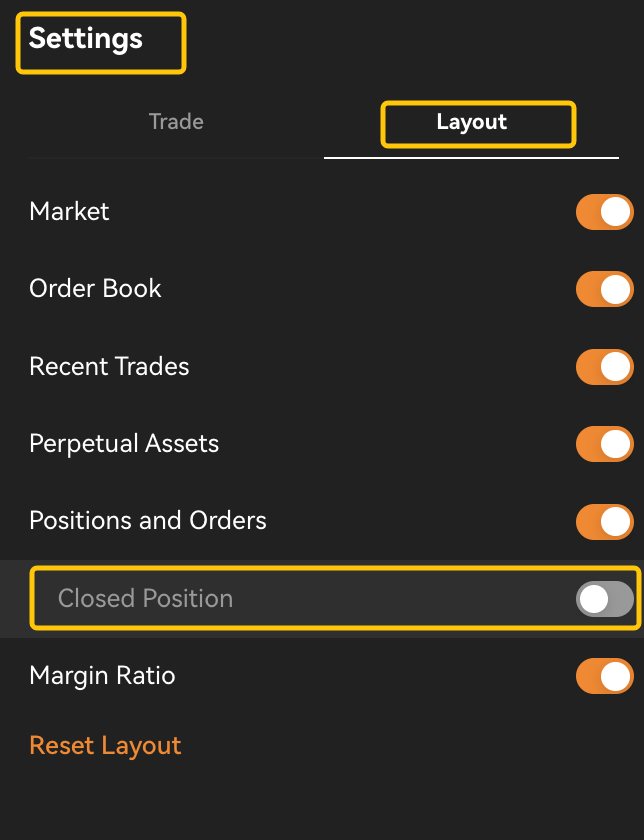

Turn on the [Closed Position] from Settings, you will find it will be displayed on position tab.

All closed position will be recorded in [Closed Position]. You can check the average close price, realized PNL, trading fees, funding fees ,ROI and other details for each closed position.

Closed PNL=Realized PNL+Trading Fee+Funding Fee

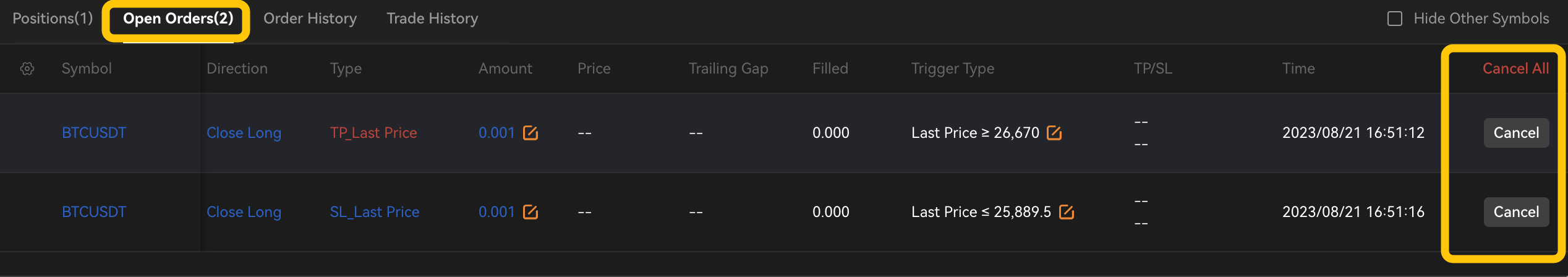

Instructions on Open Order Tab

The open order tab shows the limit orders placed by the trader. Traders can also amend the order price, order quantity, TP/SL or cancel the orders from this page.To cancel all open orders at once, please click on the [Cancel All] button from the upper right corner.

Trader can check all your completed orders and transactions under [Order History] and[Trade History].

How to use trading chart ?

OrangeX trading chart provides diversified functions to meet traders's trading needs.

There are three (3) types of quick trading features currently only available on the OrangeX website.

1. Quick Trade on Market Order

2. Quick Reverse and Quick Close

3. Quick Position and Order Check