If the market reaches your specified price, your order will be executed at that order price or a better one if the order price is less favorable than the market price.

How to set up your Market Order?

A Market Order is the simplest type of order, commonly used when you want to execute a trade swiftly at the current market price.

a.) Click Market

b.)Enter your desired order amount. You can switch the order unit from USDT to coin quantity.

c.)Select Open Long or Open Short.

d.)Final check the order details, then click on Confirm.

Your order will be executed immediately at the best available price (i.e. best bid price for a sell order or best ask price for a buy order), ensuring swift entry or exit from a position.

How to set up Conditional Order?

Conditional orders provide a layer of automation to your trading strategy. These orders are triggered and placed into the order book when certain conditions, such as a trigger price, are met. Traders can use different reference prices as the trigger basis, such as Last Traded Price, Mark Price, and Index Price.

a.) Click Conditional

b.)Enter the Trigger Price. You can select the trigger price type from Mark Price or Last Price.

the order unit from USDT to coin quantity.

c.)Enter the desired price.This is the actual executed price after your conditional order is triggered. You can select the executed price type from Market Price or Limit Price

d.)Enter your desired order amount. You can switch the order unit from USDT to coin quantity.

e.)Select Open Long or Open Short.

f.) Final check the order details, then click on Confirm.

For OrangeX App Users:

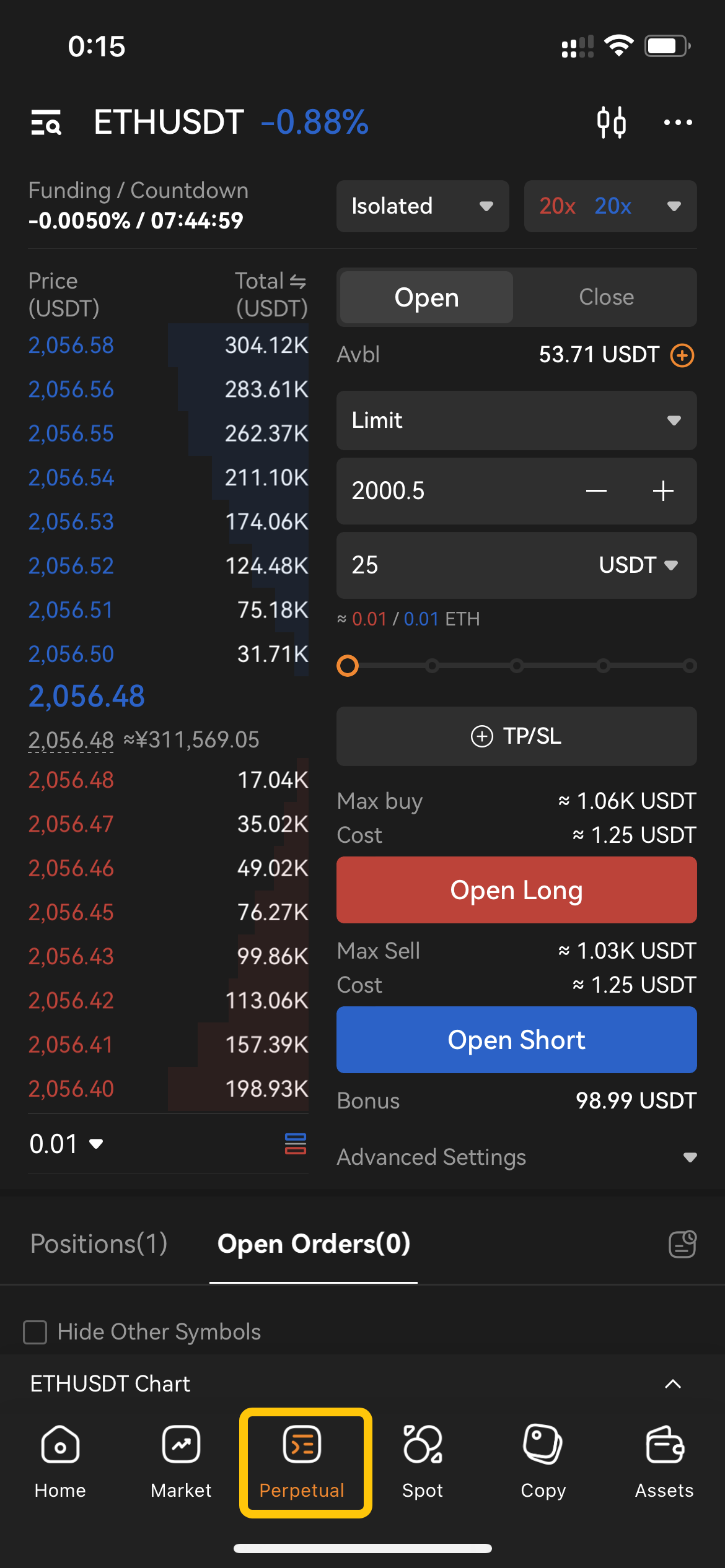

Step 1: Launch OrangeX App and open Perpetual page. Set your margin mode(Cross/Isolated) and leverage on the top of order zone.

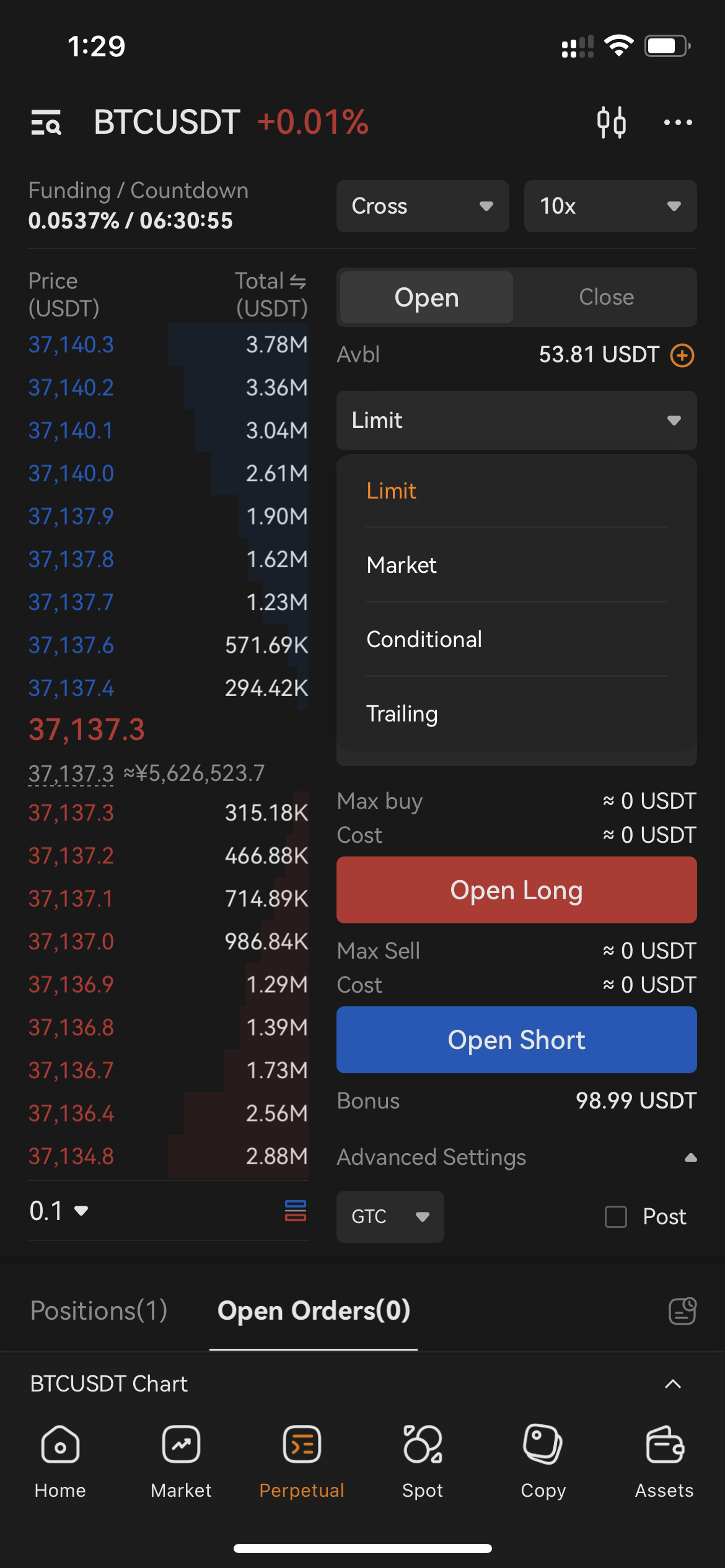

Step 2: Select your desired order type from Limit, Market and Conditional.

How to set up Limit Order?

a.) Select Limit

b.)Enter your desired price and order amount. You can switch the order unit from USDT to coin quantity.

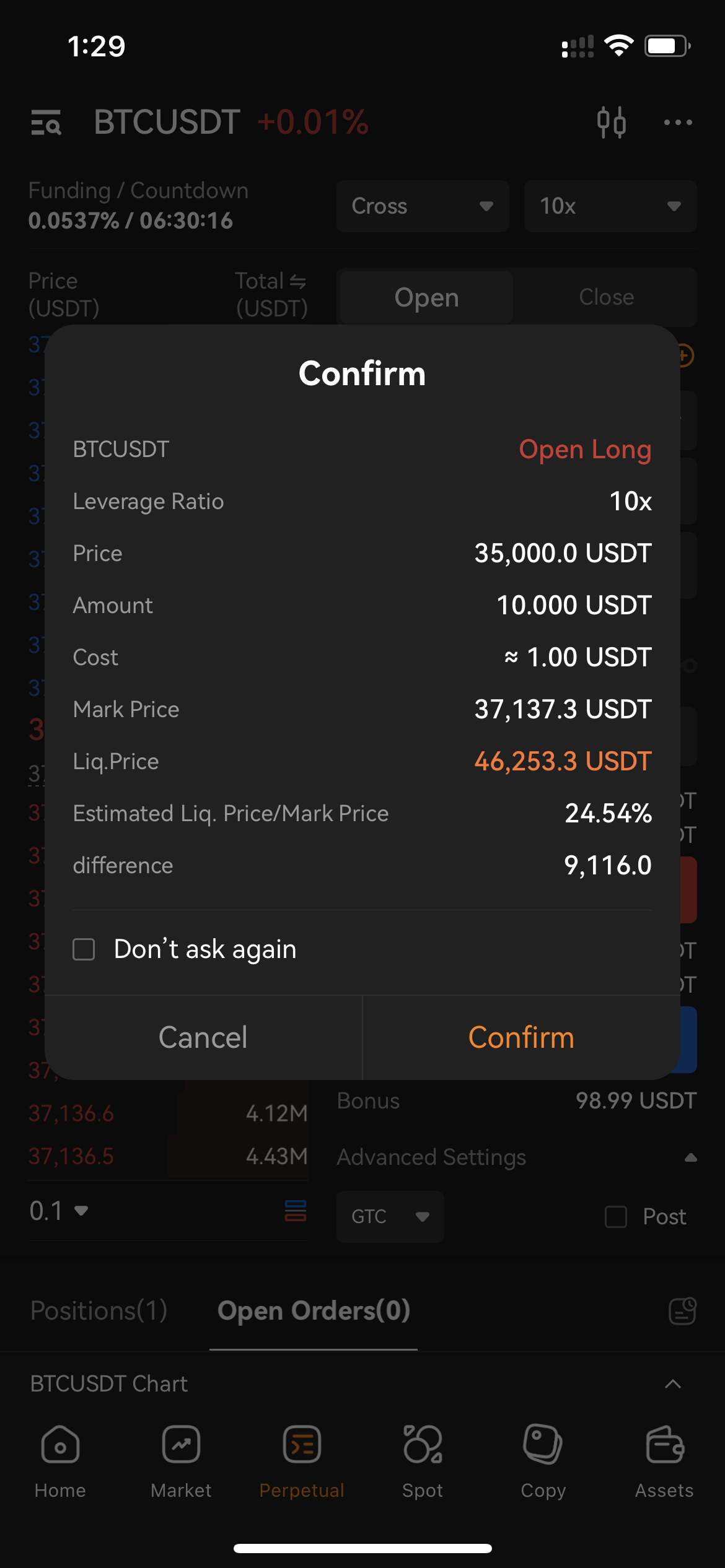

c.)Select Open Long or Open Short.

d.)Final check the order details, then click on Confirm.

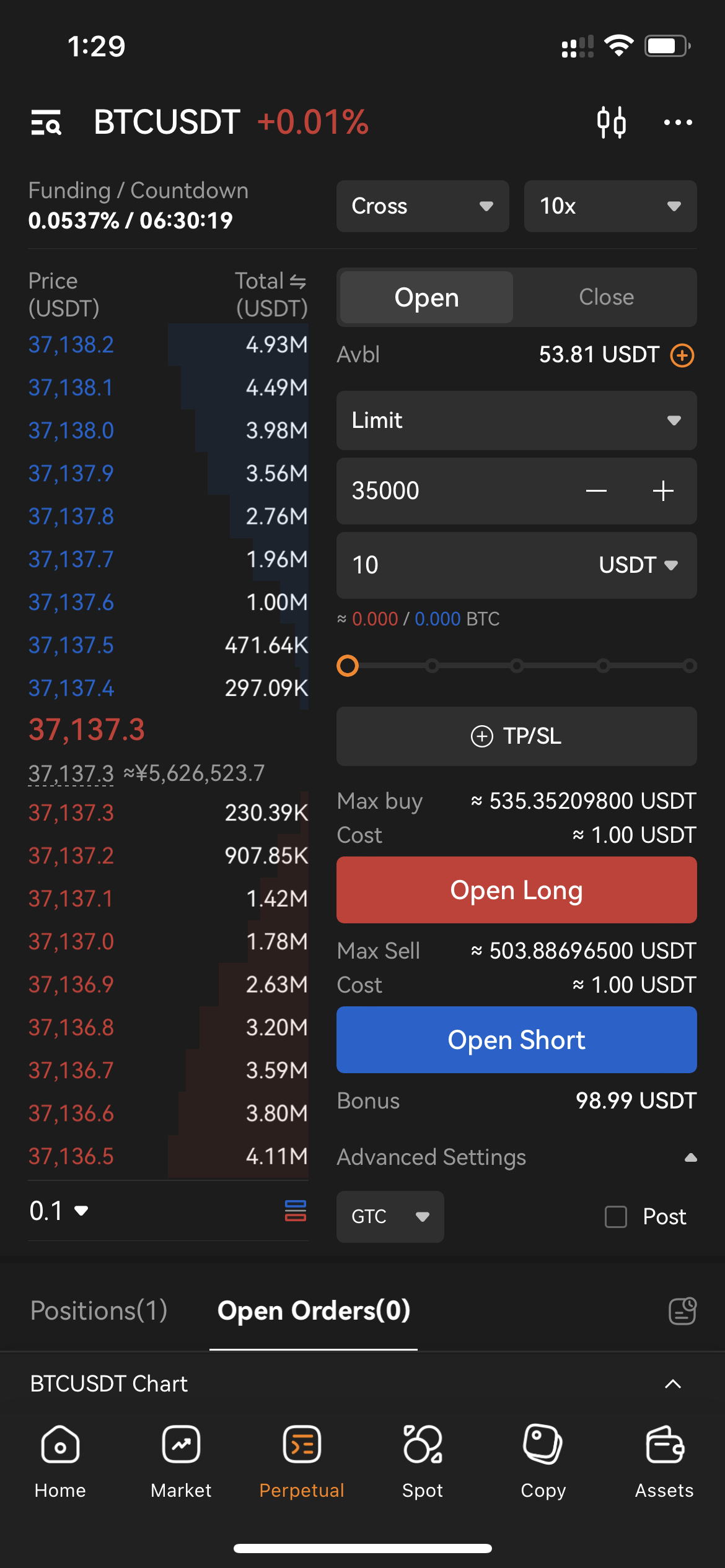

How to set up your Market Order?

a.) Select Market

b.)Enter your desired order amount. You can switch the order unit from USDT to coin quantity.

c.)Select Open Long or Open Short.

d.)Final check the order details, then click on Confirm.

How to set up Conditional Order?

a.) Select Conditional

b.)Enter the Trigger Price. You can select the trigger price type from Mark Price or Last Price.

the order unit from USDT to coin quantity.

c.)Enter the desired price.This is the actual executed price after your conditional order is triggered. You can select the executed price type from Market Price or Limit Price

d.)Enter your desired order amount. You can switch the order unit from USDT to coin quantity.

e.)Select Open Long or Open Short.

f.) Final check the order details, then click on Confirm.