Using the above picture as an example. For this short position order, the trailing TP/SL order's parameters are set as follows: "Activation Price = 10,500", "Callback Rate = 5%", and "Quantity = N". The price starts moving from point A, then:

When the price reaches point B, which is the activation price of 10,500, the trailing TP/SL order will be activated. At this time, the trailing TP/SL order's trigger price = 10,500 * (1 + 5%) = 11,025

When the price falls to 10,000, which is the lowest price in history, the trailing TP/SL order's trigger price = 10,000 * (1 + 5%) = 10,500

When the price rises but does not reach the callback rate of 5%, since the lowest price in history is still 10,000, the trailing TP/SL order's trigger price remains unchanged at 10,500

When the price falls to 9,500, which is the lowest price in history, the trailing TP/SL trigger price = 9,500 * (1 + 5%) = 9,975

When the price drops to point C, the price is 9,975, reaching the callback rate of 5% and triggering the trailing TP/SL order to close the position at market price.

2. Use Cases of Trailing TP/SL Orders

Case 1: When a long position is closed in a favorable direction (rise and fall)

Current Position: 1 BTC long position Open Price: 30,000 Latest Market Price: 31,000 Based on the current market price, estimated unrealized PnL = (31,000 - 30,000) * 1 = 1,000 USDT. Assuming: It's determined that each price rise has a callback rate of no more than 3% based on the recent market movements. Prediction: Any callback rate of no more than 3% can be considered a normal callback in the near future, and the market will continue to move upward. On the contrary, a callback rate exceeding a certain value (let's say, 5%) can be interpreted that the bullish momentum having ended (the price rises no further and is likely about to plummet). In this case, the position must be closed before the market price plummets.

So, we set a trailing TP/SL order with the following parameters: Activation Price: 32,000 Callback Rate: 5%

As long as the latest market price continues to rise to 32,000, the trailing TP/SL order will be activated. As the market continues to rise, the system will automatically close the position at the market price when the callback rate reaches 5%.

Case 2: When a short position is closed in a favorable direction (fall and rebound)

Current Position: 1 BTC short position Open Price: 30,000 Latest Market Price: 29,000 Based on the current market price, estimated unrealized PnL = (30,000 - 29,000) * 1 = 1,000 USDT. Assuming: It's determined that each price dip has a callback rate of no more than 3% based on the recent market movements. Prediction: Any callback rate of no more than 3% can be considered a normal callback in the near future, and the market will continue to move downward. On the contrary, a callback rate exceeding a certain value (let's say, 5%) can be interpreted that the bearish momentum has ended (the price falls no further and is likely about to rise). In this case, the position needs to be closed before the market price rises quickly.

So, we set a trailing TP/SL order with the following parameters: Activation Price: 28,000 Callback Rate: 5%

As long as the latest market price continues to fall to 28,000, the trailing TP/SL order will be activated. As the market continues to fall, the system will automatically close the position at the market price when the callback rate reaches 5%.

3.How to Set Up Trailing TP/SL?

There are three key parameters when setting up trailing TP/SL:

Callback Rate (Required) The callback rate is the main condition to calculate the actual trigger price. The actual trigger price will be calculated based on the historical highest/lowest price and the callback rate. To set a callback range, choose either "Callback Rate" or "Trailing Distance."

Callback Rate: Assuming that the highest price on record is 50,000 USDT and the callback rate is 5%. When the price drops to 47,500 USDT = 50,000*(1-5%), the system will sell the order.

Trailing Distance: Assuming that the highest price on record is 50,000 USDT and the trailing distance is 5,000 USDT. When the price drops to 45,000 = 50,000 - 5,000, the system will sell the order.

Quantity (Required) The amount of the trailing TP/SL order. Activation Price (Optional) The activation price is a prerequisite for the trailing TP/SL order to be activated. When the last price (latest transaction price) reaches or exceeds the activation price, the order will be triggered. After activation, the system starts calculating the actual trigger price for the trailing TP/SL order. If you don't specify an activation price, it will be immediately activated when the order is placed. The activation price can default to the current price (choose either Mark Price, Last Price, or Index Price).

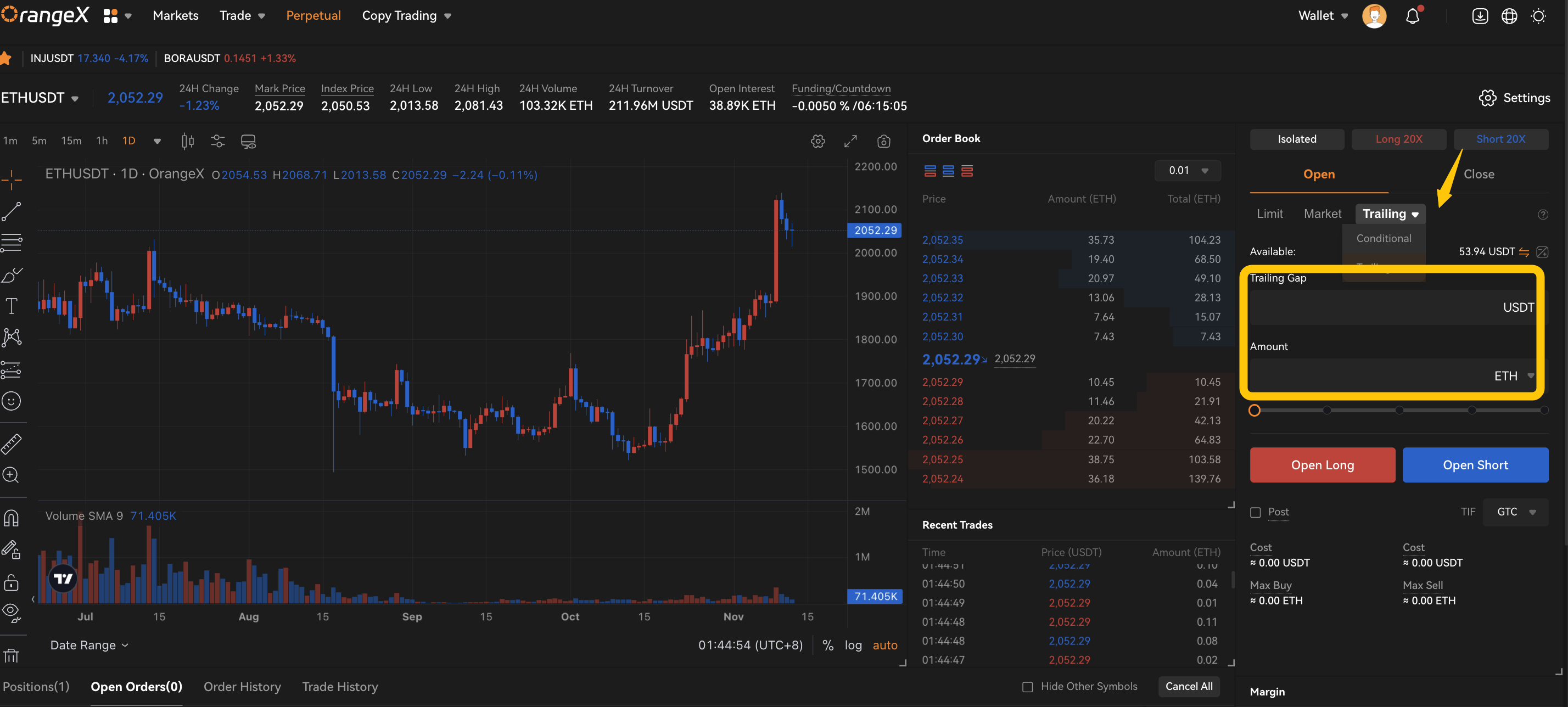

To make it easier to understand, you can go and see the features in the order book shown in the picture below:

4. Notes:

(1) Your positions will not be frozen before a trailing TP/SL order is triggered.

(2) A trailing TP/SL order may fail to be triggered due to factors such as the contract being not tradable. Once successfully triggered, the subsequent market order might fail to be executed just like a regular market order. You can find the unfilled market orders under Open Orders.

(3) If the order is filled, it will either close your existing position in full or part. If your order fails to be filled, your position will remain open.

(4) The amount of orders that can be placed with a trailing TP/SL order varies for different types of contracts. The orders will be placed at the market price. The restrictions are subject to changes in market conditions.

*Important Notes:

Setting an optimal callback rate and activation price could be a daunting process.

For a trailing TP/SL to be effective, a callback rate should neither be too small nor too large and the activation price should neither be too close nor far away from the current price.

When the callback rate is too small or the activation price is too close, the trailing TP/SL is too close to the entry price and is easily triggered by normal daily market movements. There is no room for a trade to move in the direction favorable to traders before any meaningful price move occurs. The trade will close/exit at a point where the market took a temporary dip and then recovered, resulting in a losing trade.

On the contrary, if the callback rate is too large, the trailing TP/SL will be only triggered by extreme market movements, which means the traders are taking on unnecessarily large risks.

A higher callback rate is generally a better bet during volatile periods, while a lower callback rate is preferable during normal market conditions. There is no ideal optimal callback rate and activation price.

Traders are advised to revise their trailing TP/SL strategy from time to time based on price fluctuations in the market. You should always carefully consider whether a trade is consistent with your risk tolerance, investment experience, financial situation, and other considerations that may be relevant to you. In addition to the range of price changes, always determine your callback rate and activation price based on your profit target and loss tolerance.